Put Land at the Center

Building fairer, more prosperous communities through centering land in economic policy.

2025 J.M.K. Innovation Prize Awardee

The Center for Land Economics conducts research and provides education to promote equitable assessments and foster sustainable development for the benefit of communities.

Our Work

Ideas to Action

Progress and Poverty Substack

The pulse of land value taxes: Weekly updates, thought-provoking commentary, and much more on Progress and Poverty.

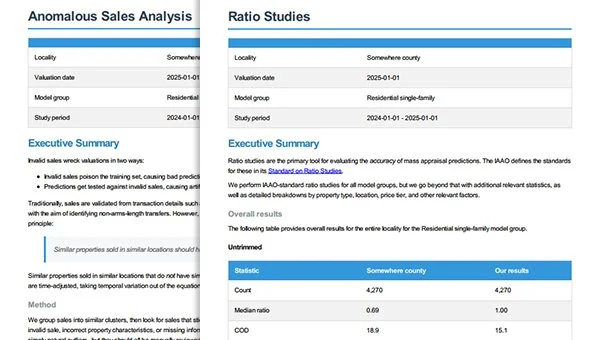

Mass Appraisal for the Masses

Modern, cutting-edge, free and open source mass appraisal toolkit for researchers, analysts, governments, and everybody else.

Land Value Tax Research

In-depth LVT modeling, data-driven insights, and comprehensive reports illuminating the story of cities through land value.

CivicMapper

Interactive 3D mapping for visualizing land values and urban potential.

The value of land returned to the community that makes it valuable.

In the News

Spokane leaders eye property tax reform to promote building

Spokane leaders are advancing a land-value tax pilot proposal informed by analysis from the Center for Land Economics, which would shift property taxes off new buildings and onto vacant lots and parking lots to curb speculation and accelerate housing development.

Tax Land, Not Buildings, to Spur Development

Greg Miller writes in The Rooftop series for New America on the need to center property tax reform in discussions on housing supply. Cities should start by taxing land, not builings.

The Squares That Guarantee a Real Estate Win

Lars Doucet of the Center for Land Economics explains how Monopoly’s Georgist origins mirror today’s housing affordability crisis—and why land value taxes are gaining real-world momentum as a path toward housing abundance.

Could the Land Value Tax Solve the Housing Shortage?

Greg Miller of CLE makes the case that shifting property taxes from buildings onto land through a land value tax could unlock faster housing production.

NY land value tax proposed to make housing affordable

New York legislators are proposing a land value tax pilot program, an idea backed by experts from the Center for Land Economics.

Connecting Value Creation with Value Capture

Greg Miller presents at the Strong Towns National Gathering on the need to consider land value taxes to unlock the market toward infill development.

State chronically undervalues vacant land in Baltimore

The Baltimore Banner speaks with the Center for Land Economics covering CLE’s report uncovering systematic undervaluation of vacant land in Baltimore.